Last May, I seriously started tracking my weight. I was on my highest weight post baby #2 and I know that I’m ready to lose the baby weight I gained since baby #1. I added another 25 lbs while I was pregnant with baby #2. I lost 10 lbs about a month after giving birth.

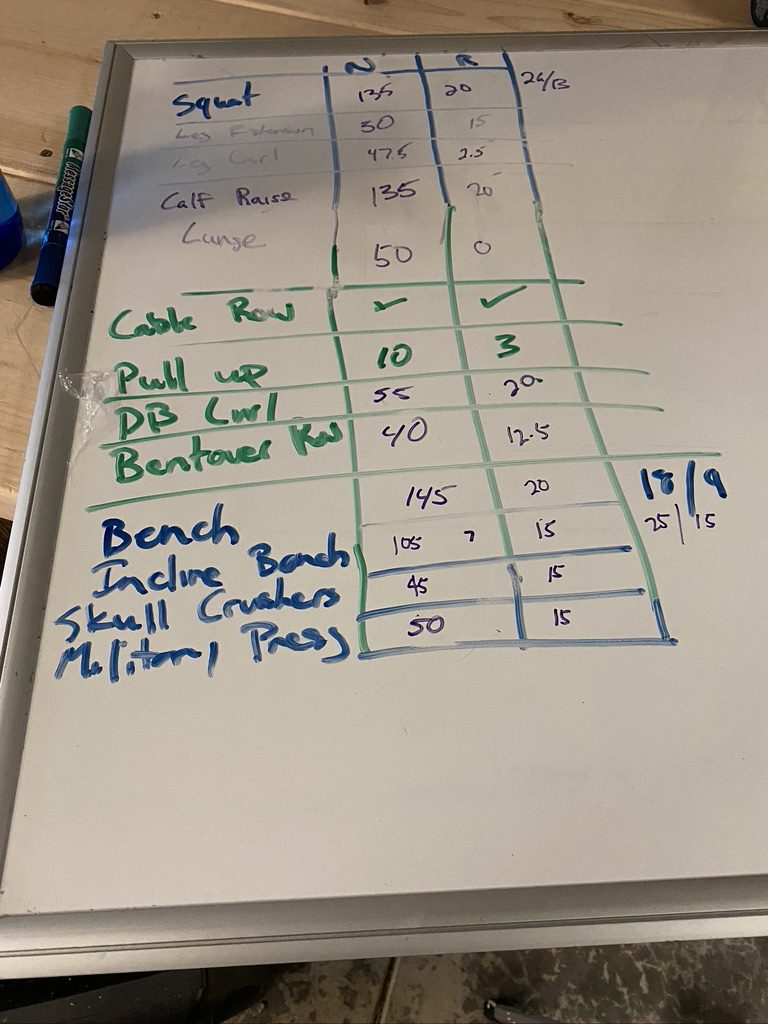

Exercise

My husband and I started going to our home gym (set up by my husband) once AHP was sleep trained at about 10 weeks. It was my first time weight training and I have to start from 0 lbs, just using my body weight in the beginning. I’m also not doing any abs work out until I can see a pelvic floor physical therapist. Unfortunately, the women’s health PT was furloughed at our local ATI branch so I still haven’t seen one. By end of May, I started tracking my weight and my diet.

Tracking my diet

I was eating mindlessly and the pandemic didn’t help. I also have sweet tooth, and have an obsession with Nutella. It just hit me one day, after seeing a photo with my newborn that I didn’t like what I see. It also gives me a chance to be in control again with my own body or at least to feel that it’s mine shared of course with AHP, while I’m nursing.

Picking an App – Noom vs My Fitness Pal

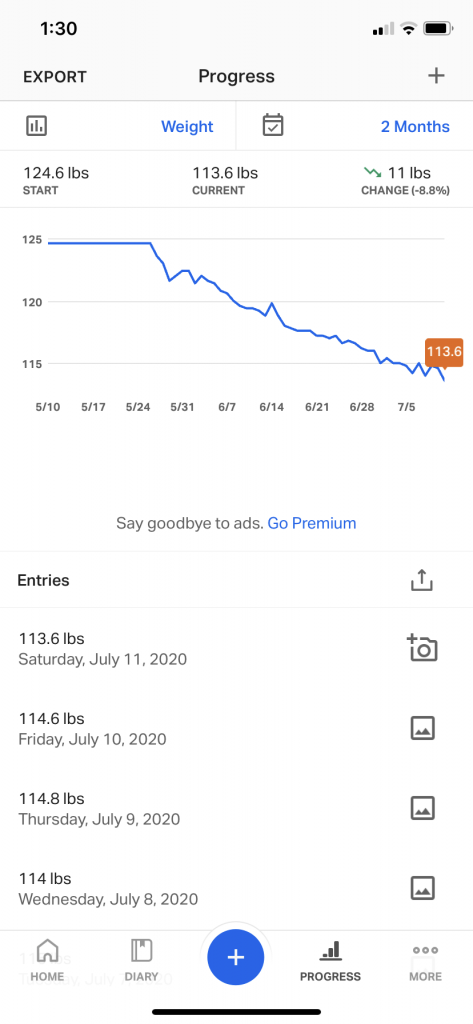

I saw an Ad about Noom and started reading some reviews online. It seems that users were pretty happy with it and saw great results. At the same time, there’s a lot of comparison about Noom and MyFitnessPal. I downloaded both. I paid $1 to use Noom for 2 weeks while MyFitnessPal is free. On May 26, I had my first weigh in at 124.6 lbs. This is about 19 lbs heavier pre-pregnancy. Noom projected that I will be on my goal weight by September. I liked Noom in the beginning. Noom gives you article to read everyday as a form of motivation. As it advertised, it is all about psychology. Every item has a check mark. There are about 7 – 8 things you have to do for the day. You will also have access to a community and a coach after a free trial. MyFitnessPal has a premium version which you have to pay for. I only uses the free app. In my opinion MyFitnessPal has a better user interface and more food recipe on their database. It also has some exercises and articles that you can read on your own.

After about a week of tracking my food intake and my weight, I decided to use MyFitnessPal instead of Noom. Reading articles from Noom just didn’t work for me. On June 26, I’m at 116.8 lbs, losing 7.8 lbs in one month.

Using MyFitnessPal

It’s pretty straight forward. You put in your weight, height, age and your goal weight. You are then allowed to have a certain calories per day and you are supposed to track what you eat. Mine was set to 1230 calories. Since I’m nursing, I allow myself to go more than 1230 and consume about 300 to 500 calories. 1230 calories is not a lot, so I need to budget what I eat. At this point, I am really glad that I’m nursing so I can eat more.

In addition to counting calories, I also start intermittent fasting or really skipping breakfast. This is easy for me since I sleep during AHP’s first nap. I have coffee during the day and my first meal is usually around 11:30. In the beginning, I was really strict and I tried to consume just 1,230 calories, but I did get hungry and realize that I need to eat more since I’m still nursing and burning a lot of calories. I lost 3 lbs on that first week, which is probably not healthy. Right now, I’m losing about 1 – 1.5 lbs a week and I’m pretty happy with that.

Eating Right

I also learned more about nutrition. Obviously, I know that fruits and veggies are good for you but I never looked at the nutrients of foods that I eat. As I said, I like sweet A LOT. Knowing that 1 serving of Nutella or about 2 tablespoons are 200 calories, not to mention another 110 calories from the bread really put it in perspective. I am eating 310 calories of mostly sugar. I realized that I like rice a lot, but can cut it down and be satisfied with 2/3 of a cup. I went back on eating more fruits for dessert and been enjoying more cantaloupe, mangoes and apples. I have harder days. After 2 weeks, we celebrated MBP’s birthday, I devoured cupcakes and tons of Filipino food. There are days that I will still mindlessly eat once the kids are in bed, while I’m watching some TV. This is hard and I never thought that I will have a problem losing weight. In fact, growing up, I have a problem gaining weight. I tried to keep myself occupied and for the month, I listed some things that I want to do that will keep me busy.

Keeping track of weight

I weigh myself every morning, before I start my day. Weight fluctuates during the day and I’m usually lighter in the morning. This week, I fluctuate between 114.5 ~ 113.6 lbs. It’s annoying when I move up from the previous day since I like looking at the downward graph. I have to remind myself that I should really look at the trend on a weekly basis.

Goal

My end goal is to be at 105 lbs. I’ve been on this weight for a good 17 years before pregnancy. At the same time, I also want to build some muscles. I’d like to be on my ideal weight by the end of September, keep it and stay healthy.

Watch out for progress!!