I’ve been using H&R block software for the last 3 years. I used the downloadable software which allows me to e-file 5 federal returns. I used the software to file ours (1), my 3 siblings (3) and my parents (1). I used the premium version which cost $54.95 at Amazon.

What is a Backdoor Roth IRA?

According to Mootley Fool, “A backdoor Roth IRA is a retirement savings strategy whereby you make a contribution to a traditional IRA, which anyone is allowed to do, and then immediately convert the account to a Roth IRA.”

In layman’s term, a backdoor Roth IRA is a way to contribute to Roth IRA if you are above the income threshold that the IRS allows. You can find the threshold on IRS website.

Ideally, your traditional IRA balance is 0 before contributing to backdoor Roth IRA. You can do this by rolling your traditional IRA balance to your 401k, before doing this conversion.

For this scenario, Taxpayer (TP) has 0 dollar balance in traditional IRA. This is done by moving the balance to the TP’s current 401k. In January 3, 2022, TP contributed $6,000 to a traditional IRA. In January 5, 2022, TP convert the traditional IRA to Roth IRA. By December 30, 2022, TP has 0 balance in traditional IRA.

TP receives the following IRS document from the brokerage account:

- Form 5498 IRA Contribution for Traditional IRA

- Form 1099-R: Distributions from Pensions, Annuities, Retirement or Profit Sharing Plans

- Form 5498 IRA Contribution for Roth IRA

Step 1:

Add all your income from W2s and other incomes.

Step 2:

Add the IRA contribution. You will see this under the Federal Section –> Adjustment Tab

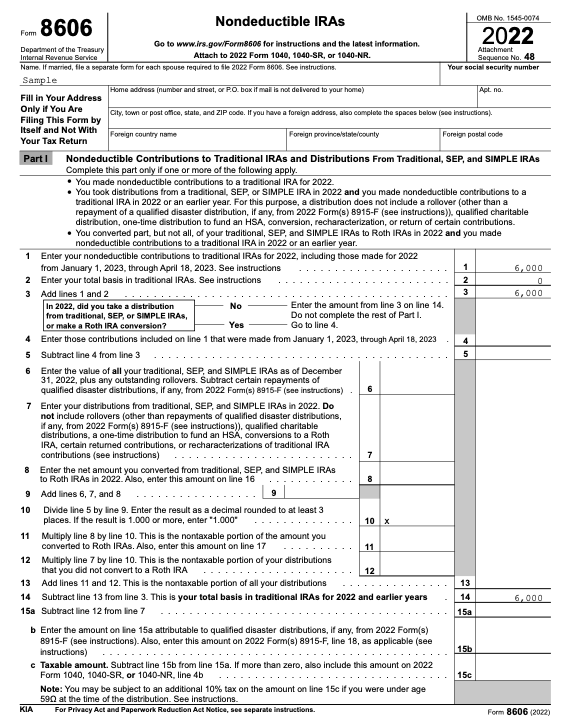

This will trigger the software to create a form 8606, Non Deductible IRAs and it will look like this:

Step 3:

Add the 1099-R. This is the distribution made from Traditional IRA because you converted the contribution to Roth IRA.

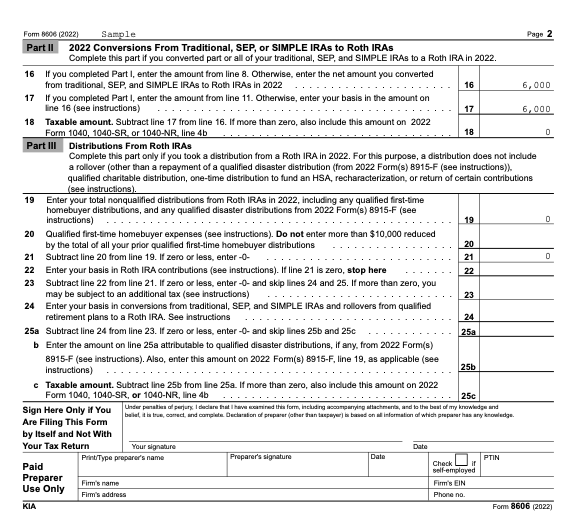

You now have conversion documented in Form 8606, step 2 and it will like below:

Congrats! You now completed the form 8606 for 2022 tax year.