January 8, 2022

This day was a non-Disney day. I specifically planned for this because I did not want to fight the weekend crowds in Disney. In addition to regular tourist crowds, locals also go to Disney, especially on weekends. I made a reservation for a Disney character brunch at Storyteller Cafe instead. This will still give us a Disney feel, without going to the park. I booked this brunch 60 days out because I heard that reservations were hard to obtain. I basically counted 60 days before this day and booked the reservation on the Disneyland App.

The storyteller cafe is located at Disney Grand Californian Hotel. I didn’t know the directions, so we followed google maps. We left about an hour before our reservations to give ourselves enough time, in case we get lost. We did the usual trek to Disneyland parks and went through security. Instead of going to the parks, we followed the sign to Downtown Disney and hoped for the best — that there is a sign that will lead us to Disney Grand California. Well, I was wrong. We walked all the way and were about to leave downtown Disney. I asked the security and she mentioned that we passed it. So we went back. Another person from one of the stores, gave us a better direction to turn right after The Disney’s Dress Shop store. We saw the store and I followed the signs to the restaurant. We got there 10 minutes before our reservation and checked in. We didn’t have to wait long until our table was ready.

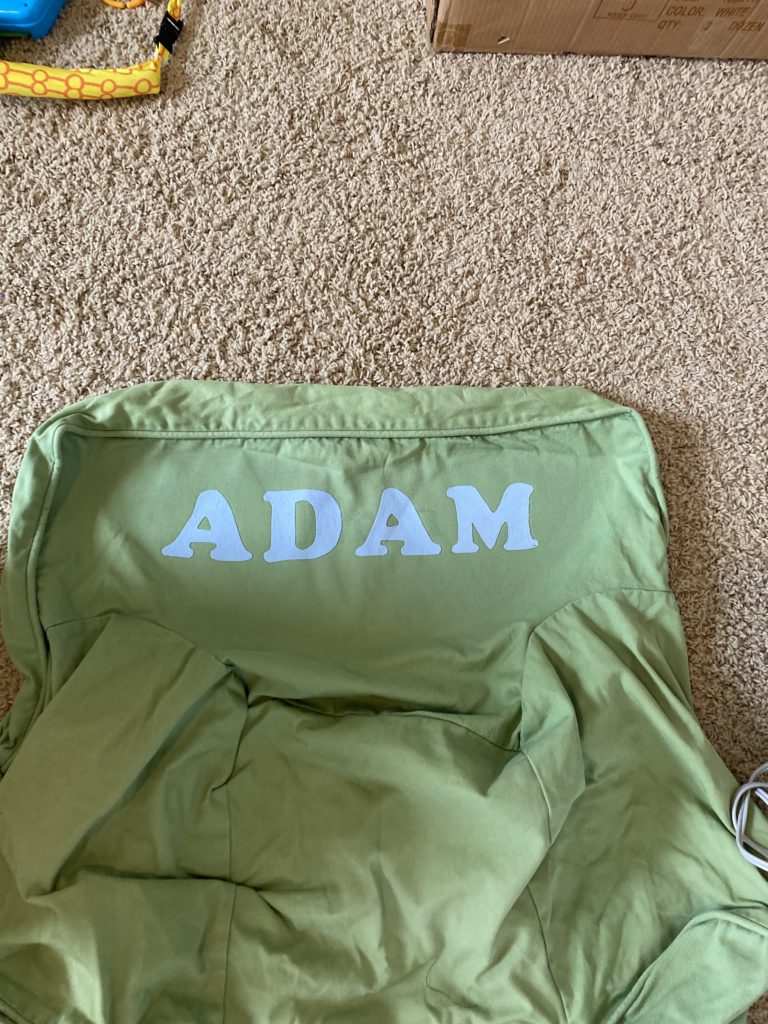

The brunch is a buffet style with a typical brunch menu. I wasn’t impressed with the food on the buffet – I mean it was good, because bacon is good. I don’t think you can screw it up, but it also doesn’t have a lot of “healthy” selection. I ordered off the menu, and the food was better. The chicken skewer was actually delicious and the avocado toast was decent. I also ordered some chicken and fries for the kids, and of course they enjoyed it. The highlight of the brunch was the character sightings. The kids watched out for it, but it was just OK. Because of COVID, the characters just walked around the restaurants. I expected this, but we already saw the same characters at the park, so it wasn’t new to the kids. AHP also had a hard time sitting and started running around the restaurants. There was one time he ran to the characters – which of course you can’t do. Since AHP is about to be 2 next month, I asked the server for a special cake. He got him a rainbow cupcake for the boys and we sang Happy Birthday to AHP. He didn’t know how to blow a candle, and was about to cry. Unfortunately, the singing stopped and he enjoyed the icing on the cupcakes.

The kids are definitely done with the restaurant after an hour and 3 sightings of the same characters. AHP and I stayed outside the lobby while MBP and my husband used the restroom. AHP had fun running back and forth while one kid try to chase him. When MBP saw the kid, he immediately says “Hey, a friend is here”. He always try to say hi to other kids at the park and is always very friendly. I think he really misses his classmates, which is weird because he really doesn’t play with them in school.

We went back to our hotel on a leisurely walk, just in time for AHP’s nap. MBP had some quiet time, but didn’t really nap. He usually doesn’t nap at home, but park days make him tired, so he’s been napping the last 3 days when we visited the parks.

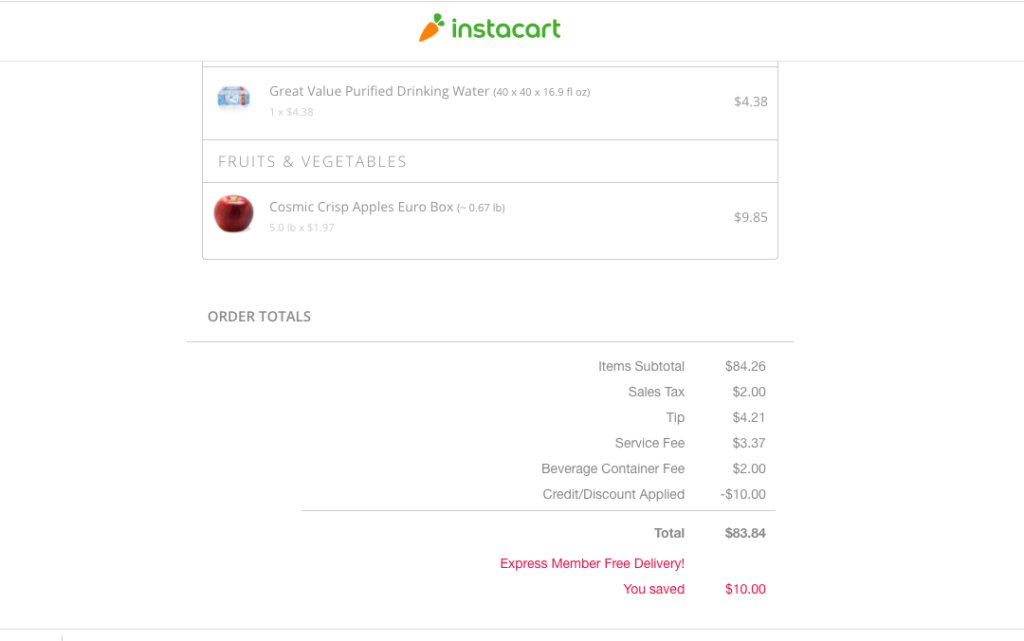

The afternoon was just hanging around our room, ordering some more fruits and water bottle from Instacart and getting pizza for dinner. Tomorrow is another non-Disney day.

Total Money Spent for the day: $131.8

Brunch – $97.15 (Excluding the $70 gift card balance from we received from my brother for Christmas)

Instacart – $31.4

Laundry: $3.25